Hey folks,

Hope you had a great week. I was on the road this week and studying for a final exam for a theology class I’ve been taking, so my reading was a little lighter than usual, but here are some recommendations that came across my desk/how I entertained myself with delayed flights.

Articles

“The Tether Scandal: The Biggest Threat to the Crypto-Ecosystem” by Mr. Whale

I’ve been cued in on Tether for a few years and continue to be skeptical about it, while unsure about when it will come crashing down. For those who don’t know, Tether is a shady company associated with also-shady crypto exchange Binance. Tether creates a stablecoin called USDT, or Tethers. Stablecoins are essentially an easy way to have dollar-equivalents in crypto without the volatility of losing 20% of your value on a tweet from a market manipulator.

The issue is, for a stablecoin to be, well, stable, they’re usually backed by something like a 1-to-1 reserve (i.e., for every 1 USDT, there would be $1 somewhere). In Tether’s case, some years ago they claimed to be 1-to-1 backed with cash and then started, quietly, claiming they were backed 1-to-1 with cash equivalents including corporate debt. Simultaneously, they grew their AUM to $40bn+. That would make them one of the biggest holders of corporate debt in the world — but the money managers who specialize in this kind of debt have never heard of them. And Tether is not being transparent at all about what they hold.

For example, here’s Tether’s “disclosure” of what backs USDT:

That’s the whole thing.

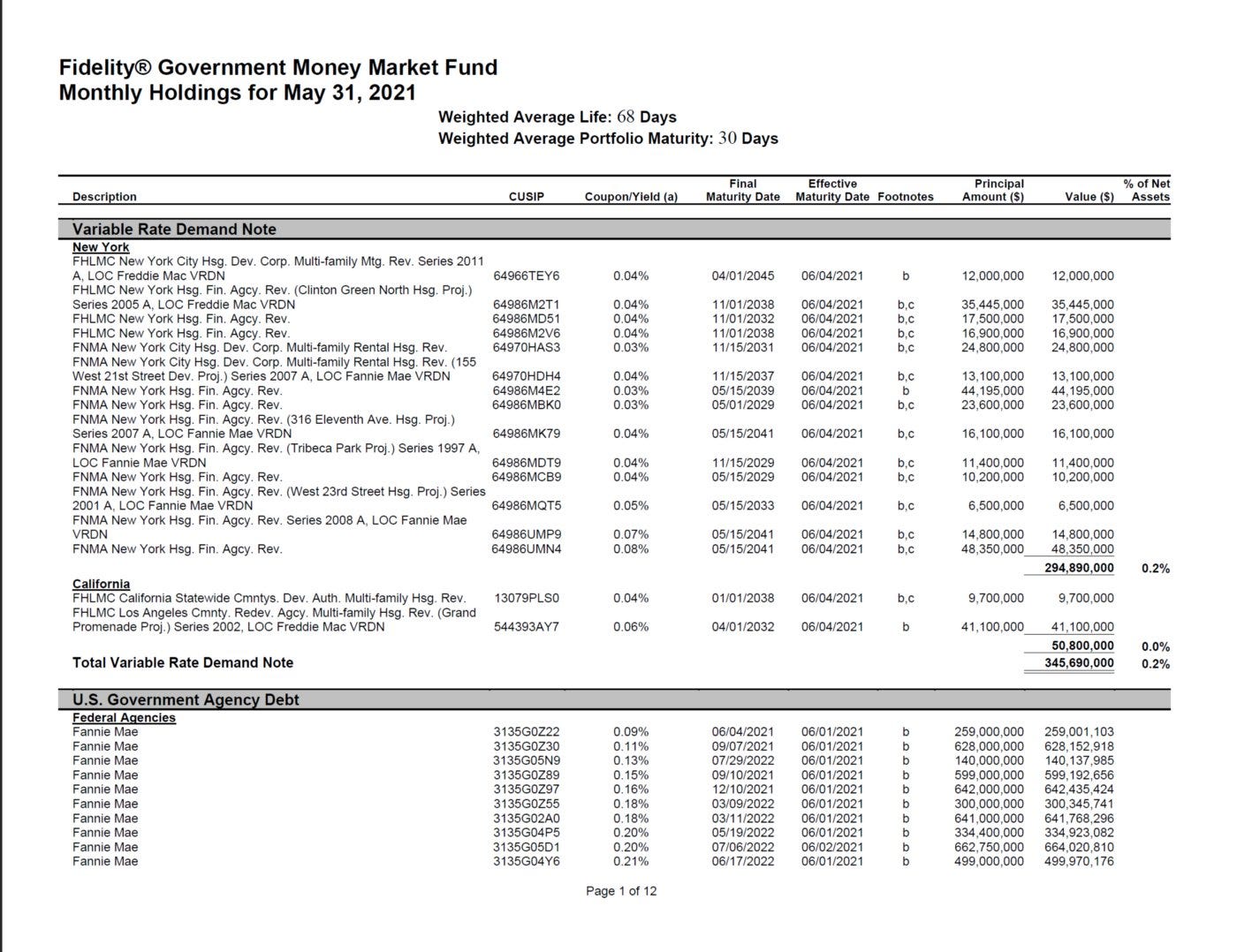

Compare that to Fidelity’s disclosure of SPAXX, their money-market fund (which is essentially what a stablecoin should be):

That’s just the first page of twelve.

(h/t @bitfinexed on twitter)

The TL;DR here is this: it’s possible Tether isn’t backed at all, is being used to pump up the prices of cryptocurrencies, and could lose its 1-to-1 peg, go to nothing, and take cryptos with it.

Unfortunately, this is a topic that is under-explored in the crypto space because it sounds like “FUD” — fear, uncertainty, and doubt — and because, if true and USDT became unpegged, it could cause cryptos to give back years worth of gains.

Hypothetically, Tether could get so much belief in its stability that it becomes its own form of fiat currency — even though everybody knows it isn’t backed by anything, it’s proven itself over the years to be resilient to skepticism and stable through that all. That could allow it to survive on the full faith and credit of its own reputation. I doubt that will happen — but it is a possibility here.

Bonus - Watch

Coffeezilla had a decent YouTube video on this a few weeks ago that you can check out here:

Books

Extraordinary Popular Delusions and the Madness of Crowds by Charles MacKay.

A fun, though at times hyperbolic, read about bubbles like the Mississippi Company bubble, the South Sea Company bubble, and Tulipmania. Seems like a relevant read with respect to cryptocurrencies, real estate, and index funds right now.

That’s it for this week. I’ll have more next week on a variety of topics as I catch up on some of my reading and listening.

Cheers,

Zak