Crypto Traders Learn the Market is a Discounting Mechanism

Or, DOGE is (Probably) Not Going to a Dollar

Anybody who has spent a little bit of time thinking about the market has probably heard “the market is a discounting mechanism.”

Generally speaking, this means that the market takes into account all publicly available information and prices it in to the price of the asset. This is why your property values don’t suddenly spike when there’s a regularly scheduled NFL game happening next weekend. It’s also why Black Friday doesn’t cause a spike in retailer stocks unless it’s a surprisingly good and busy Black Friday. It’s also why a company’s stock sometimes slips when a company meets or beats earnings expectations — the market was already optimistic with respect to EPS for this company and that ratcheted up what needed to be shown to outpace what was priced in leading up to earnings.

Any information that is widely publicly available is probably already priced in. Unless you have true insider information, you’re probably not gonna make your gains purely on information.

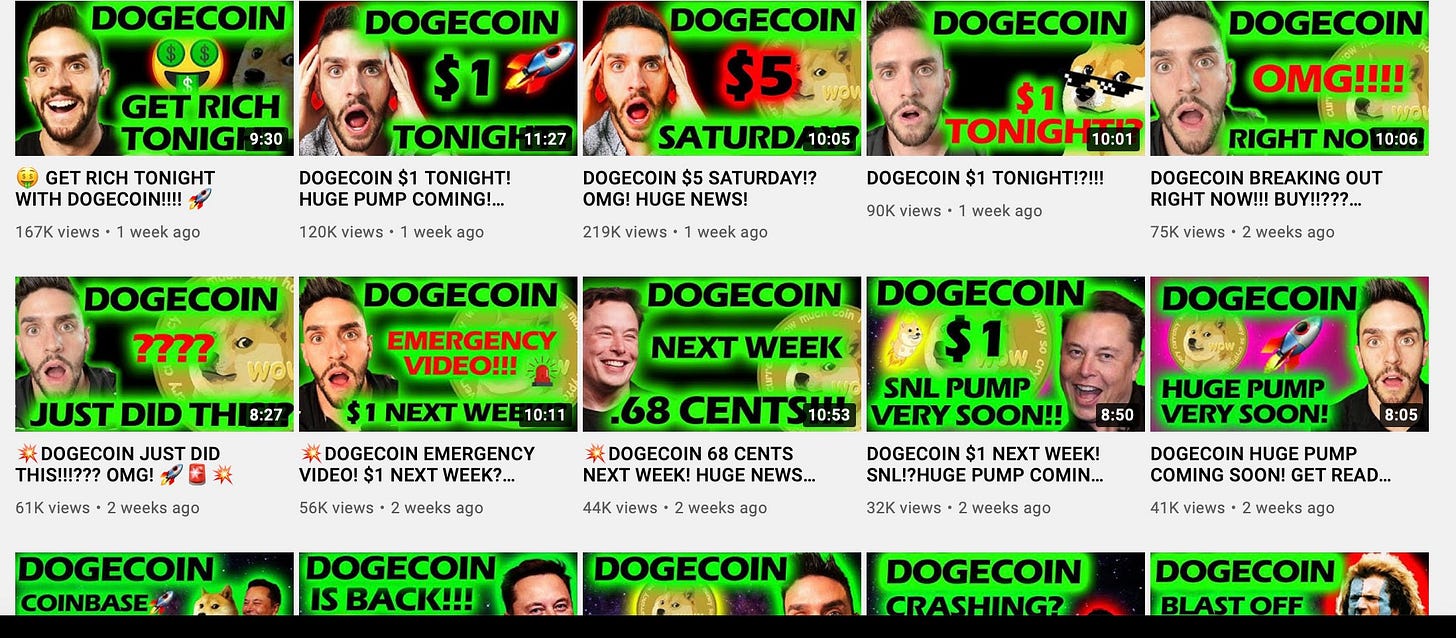

Alas, this lesson is hard-earned for those just getting into new markets for the first time. Case in point is hype and subsequent implosion of Dogecoin leading up to and following Elon Musk’s appearance on Saturday Night Live. This would be funny if it weren’t for how many well-intentioned people got burnt by hucksters. And unfortunately, it won’t be the last example of people thinking they’re getting ahead of the market when they are the market.

Crypto has been particularly affected by this fallacious line of thinking as it’s become easier for novice traders to get started in the space and for a few influencers or big names to move entire markets given the small market caps and relatively high composition of the market being retail investors.

Never mind that many of the influencers peddling different altcoins disclose neither their personal ownership nor any compensation by the teams behind those coins, hucksters have easily cropped up shilling everything from has-been altcoin Litecoin to memecoin Dogecoin and derivatives like HOKK, SHIBA, Safemoon and other transparent scams or quasi-scams.

(Dave Portnoy of Barstool Sports endorsed Safemoon yesterday, even saying, “Is it a Ponzi scheme? I don’t know, but if it is, get in on the ground floor.” nb: that every Ponzi scheme says you’re getting in on the ground floor until it implodes. I appreciate his honesty, at least.)

There are plenty of problems with all of these new get-rich-quick schemes at what sure seems like the top of a manic crypto market. Coffeezilla has covered a few on his YouTube channel here (DOGE), here (Safemoon), and here (DOGE again). He does excellent work and is not unfair to the potential that cryptocurrency has in the future.

My issue in this post is with this fallacious and dangerous thinking that you’re somehow going to get ahead of the market on news that everybody else has. This is the idea that somehow Elon Musk is going to go on Saturday Night Live (?? As if that’s a real serious point of cultural influence in 2021?) and say something that will lead markets to flood with buy orders for DOGE.

There are real hucksters out there selling this idea to people. They are using FOMO (fear of missing out, for the uninitiated) to drive more retail investors into their pet projects to drive up the price before they dump it.

Case in point:

But just take a minute to think through what would have to happen for this to be true. Just take what seems like a conservative jump by this guy’s estimates: DOGE @ $1 (nearly doubling the market cap) after SNL.

Either:

Elon would appear on SNL and give a hugely credibly endorsement of Dogecoin that it floods more than $60B into the market from A LOT of retail investors; or,

Elon appearing on SNL would drive institutional money into this memecoin in the hopes that it would somehow keep going up.

Long-term institutional investors know that Dogecoin has no real technical underpinning, so any institutional money that does flood into the coin is just taking advantage of short term movements based on the mania driven by retail investors.

So both scenarios are absurd.

Do you know what’s less absurd?

People who own these cryptos telling you they are going to go up to a certain specific price based on publicly available information and anticipation, hoping that you’ll buy in, inflating the price, so they can back out (well below the price point they mentioned but well above a profit point for them).

Take for example SHIBA, which started flooding casual socials right after DOGE crashed following Elon’s SNL appearance. Same thing happened here: people who got in early and were influential in smaller, tight-knit communities told people, “this is the next Dogecoin,” right after money flooded out of Dogecoin. It spiked a few days later, these people cashed out, and left those coming in with the bag.

This doesn’t mean that news can’t influence asset prices, of course it can. Tesla taking Bitcoin spiked the price of Bitcoin. The FDA approving a drug spikes the price of the pharma company stock. What matters is that this news isn’t publicly known until it is. By the time everybody and your uncle is talking about the Dogefather Skit on the upcoming SNL episode, the news has been priced in.

Some new hitherto unknown news would have to be announced, like Tesla taking Dogecoin, to justify the mystical spike-that-never-happened that crypto influencers were selling their audiences.

The market prices this kind of stuff in.

Put a simpler way, when your Uber driver tells you about a stock or a crypto, it’s time to sell.